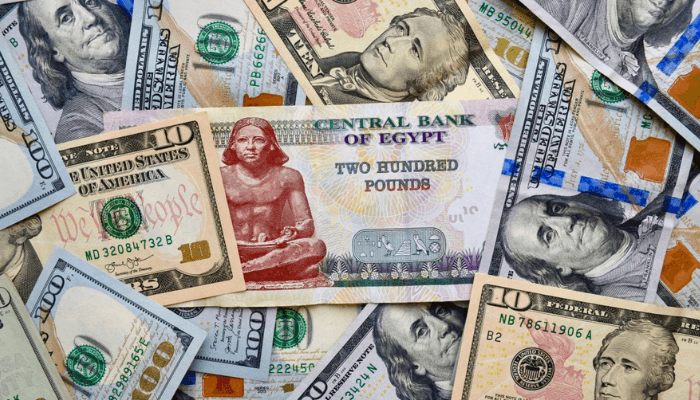

Egypt’s pound has fallen versus foreign currencies

The Egyptian pound is sliding against international currencies, approaching 50 per US dollar, following recent increases in metro fares and fuel prices.

The currency reached 49.16 per US dollar on Tuesday, according to the Central Bank of Egypt’s website.

The Egyptian pound fluctuated between 47 and 48 per dollar in June and July following its March IPO, losing over 60% of its value and plummeting to around 30 per dollar.

The new currency rates come a week after the International Monetary Fund (IMF) finished its third financial review of Egypt, allowing the government to withdraw $820 million.

The funds are part of a $8 billion rescue package to help Egypt’s faltering economy, which has been hampered by a lack of foreign currency, rising inflation, and turmoil in the Red Sea prompted by strikes by Yemen’s Houthi rebels.

Recent efforts by Egyptian authorities to restore macroeconomic stability have begun to have favorable consequences. Inflation remains high, but it is dropping. “A flexible exchange rate regime remains the cornerstone of the authorities’ programme,” the IMF stated last week.

Egyptians are dealing with rampant inflation, with the energy ministry declaring late last month that fuel prices would jump by almost 10%.

The last fuel price increase occurred in March, with the government blaming the increases on growing petroleum costs as a result of the Red Sea raids and the Egyptian currency’s depreciation.

The Houthis have assaulted commercial ships in the Red Sea in response for Israel’s war on Gaza. Oil, natural gas, and grain, among other commodities, go across the sea lanes that separate Africa and the Arabian Peninsula to reach the Suez Canal, which transports around 12% of global trade.

The National Tunnels Authority, which manages and operates the Cairo Metro, also announced a rise in fares last week. The higher rates currently vary from 2 to 5 Egyptian pounds.

Egypt signed an agreement with the IMF in the spring to more than double the size of its bailout, which now totals $8 billion. The price rises were judged required to meet the IMF’s requirements for sustained help to the country.